EyeOfTheTokenStorm

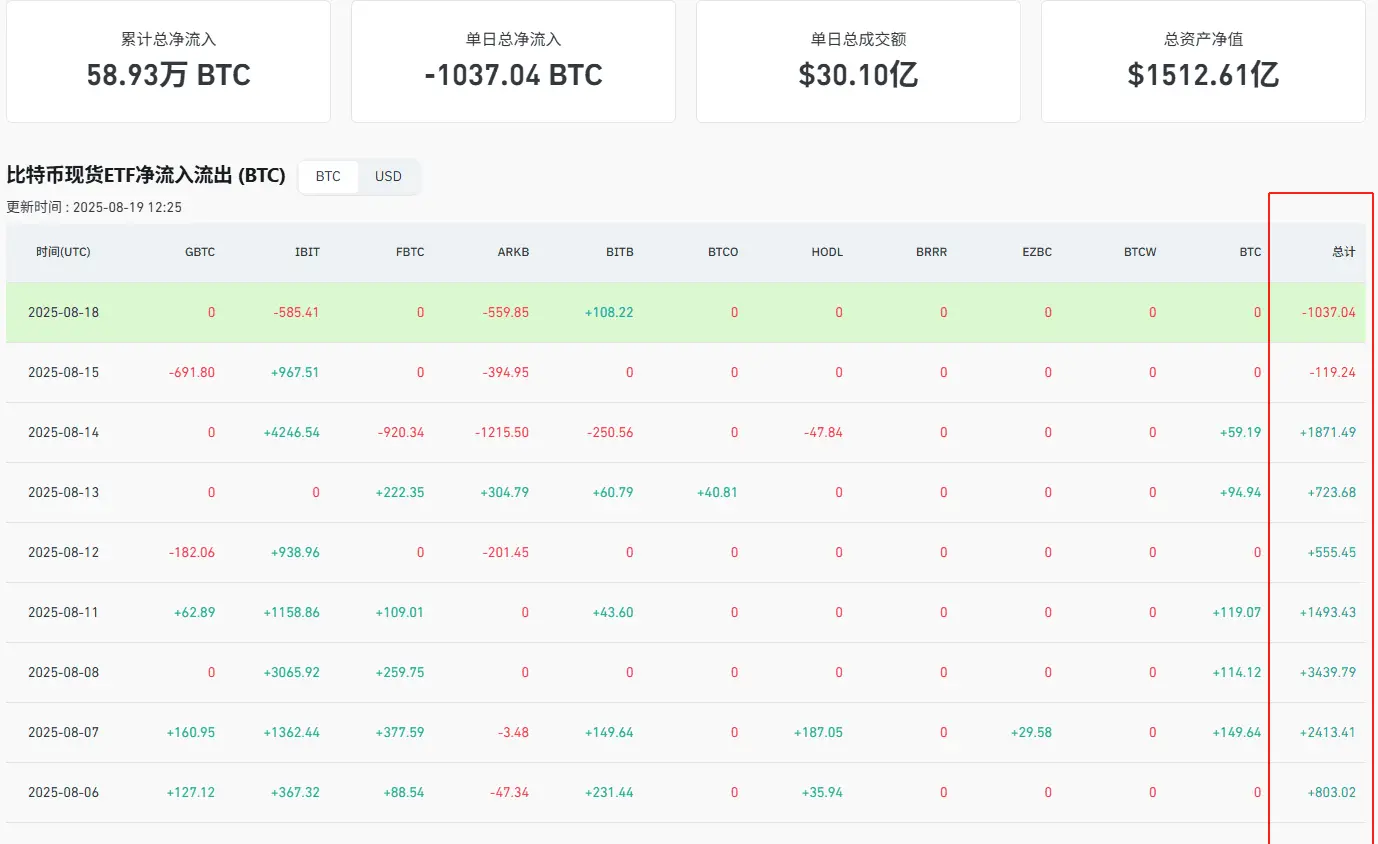

Recently, the crypto assets market has seen a remarkable shift in capital flow. Bitcoin has experienced over $1 billion in outflows in the past 7 days, but the situation began to improve in the last few hours, showing a positive inflow trend. Does this shift herald an impending reversal in the market?

Ethereum is also facing challenges, with approximately $600 million flowing out in 7 days. Although there have been positive signals in the past 8 hours, with funds starting to flow in positively, the buying strength still seems insufficient. The spot market has only attracted about $180 million

View OriginalEthereum is also facing challenges, with approximately $600 million flowing out in 7 days. Although there have been positive signals in the past 8 hours, with funds starting to flow in positively, the buying strength still seems insufficient. The spot market has only attracted about $180 million